A shift toward new models of banking

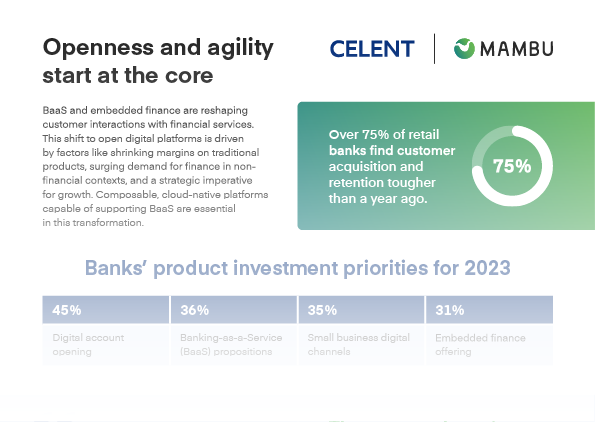

The ecosystem of financial services is becoming increasingly open. To compete and deliver distinctive customer experiences, banks need to ensure their tech stack is composable and ecosystem-driven. Incumbents need to modernise and take their cores to the cloud, or lose market share to nimble challengers who are differentiating and going where their customers are.

Celent’s latest report on embedded finance, outlines significant benefits for banks, and challenges incumbents face due to legacy technology. Get the free report and learn how a modern and composable foundation enables agility and innovation.

Download infographic

Banks can become curators of customer propositions that go far beyond their own product set and even financial services. They can also go to where their customers are, which is increasingly third party platforms where banking and nonbanking products are sold.

Read the full report on embedded finance, BaaS, and how these new technologies act as enablers for new business opportunities, taking banking services to the customer: Next-gen cores powering embedded finance.

Download the report

Are you looking to offer embedded finance?

Mambu's cloud banking platform enables modern financial experiences. With our composable technology, financial powerhouses and fintech disruptors around the world are leveraging BaaS to offer embedded finance services, winning the hearts of their customers every day.