ebankIT

Partner

ebankIT is an award-winning company with a proprietary leading Omnichannel Digital Banking Platform which enables banks and credit unions to achieve their full potential.

Region

Global, APAC, EMEA, NAM, LATAM

Connector

Connector not available

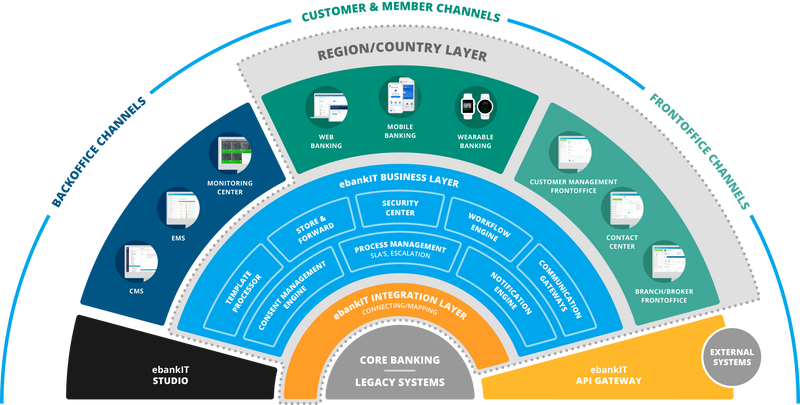

ebankIT is a leading Omnichannel Digital Banking Platform that enables banks and credit unions to run lean, run smart and innovate fast, building long and meaningful relationships with their audience and with future generations.

Every banking channel and feature is presented in one single platform, enhanced with the most innovative and customer-centric approach.

At ebankIT, we are laser-focused on Humanizing the Digital Banking Experience. Banks and Credit Unions future-proof their strategy while customers enjoy the best user experience throughout every stage and touchpoint.

ebankIT is already integrated with the Mambu API and focused on creating an interactive digital experience. Additionally, the API Gateway enables ebankIT to connect with external systems, fintechs, and 3rd parties, enabling compliance with the latest regulatory requirements such as PSD2 and Open Banking.

For more information, visit partner website.

Ready to innovate and grow with the Mambu ecosystem? Express your interest in integration solutions today.

Contact us